tax preparation fees 2020 deduction

Dont claim the deduction for expenses paid after 2020 unless the credit. Prior to 2018 investment management fees and financial planning fees could be taken as a miscellaneous itemized deduction on your tax return like tax preparation fees but.

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

However the law is only valid from 2018 to 2025.

/GettyImages-176957694_journeycrop_tax_credits_deductions-2f59ca8b74d04d7ebe651a566ff04e2f-63d62615dff540cc98818863fd2583d4.jpeg)

. While tax preparation fees cant be deducted for personal taxes they are considered an ordinary and necessary expense for business owners. The information in the article below outlines the rules for the Tuition and Fees Deduction for tax years prior to 2021. For example on your 2021 tax return you deduct the fees you paid to prepare your 2020 taxes.

Publication 529 122020 Miscellaneous Deductions. Publication 529 - Introductory Material. Senior CitizenDisabled PersonsSurviving Spouse - An annual 250 deduction from property taxes is provided for the dwelling of a qualified senior citizen disabled person or their surviving.

Those who are self-employed can still claim a tax deduction for the fees paid to prepare tax returns. However the big question is how do you write off your tax preparation fees. The cost of your.

You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey during the tax. A new client is an individual. Find a bigger refund somewhere else.

Deducting medical expenses in 2020. Congress will need to. Tax Preparation Fees 2020 Deduction.

The additional fee for Schedule E to report rental income and losses was 145. Your tax prep is free. Offer valid for tax preparation fees for new clients only.

You must use the amount reported on. The additional fee for Schedule D to report capital gains and losses was 118. You are eligible for a property tax deduction or a property tax credit only if.

This means that if you. The tuition and fees deduction is extended for qualified tuition and fees paid in calendar years 2018 2019 and 2020. 2019 2020 Tax Deductions Personal.

The average fee dropped to 220 if you didn. When calculating the property tax deduction or credit for Tax Year 2021 do not use the amount of property taxes or mobile home site fees paid for 2021. Get every credit and deduction you deserve.

Tax Preparation Fee Schedule 2020 Rivanna Wood Financial Tax Services from. Right now you can take the Tuition and Fees deduction for the 2020 tax. Medical expenses are tax deductible but only to the extent by which they exceed 10 of the taxpayers adjusted gross income.

However the law is only valid from 2018 to 2025. For example on your 2021 tax return you deduct the fees you paid to prepare your 2020 taxes. Tax preparation fees on the return.

What S The Cost Of Tax Preparation Credit Karma

Is There A Tax Preparation Fees Deduction The Motley Fool

Are Tax Preparation Fees Deductible Tax Relief Center

:max_bytes(150000):strip_icc()/TaxPrepDeduction_GettyImages-638953230-24eb5a7f108f49adb6937a499c616127.jpg)

Who Can Still Claim The Tax Preparation Deduction

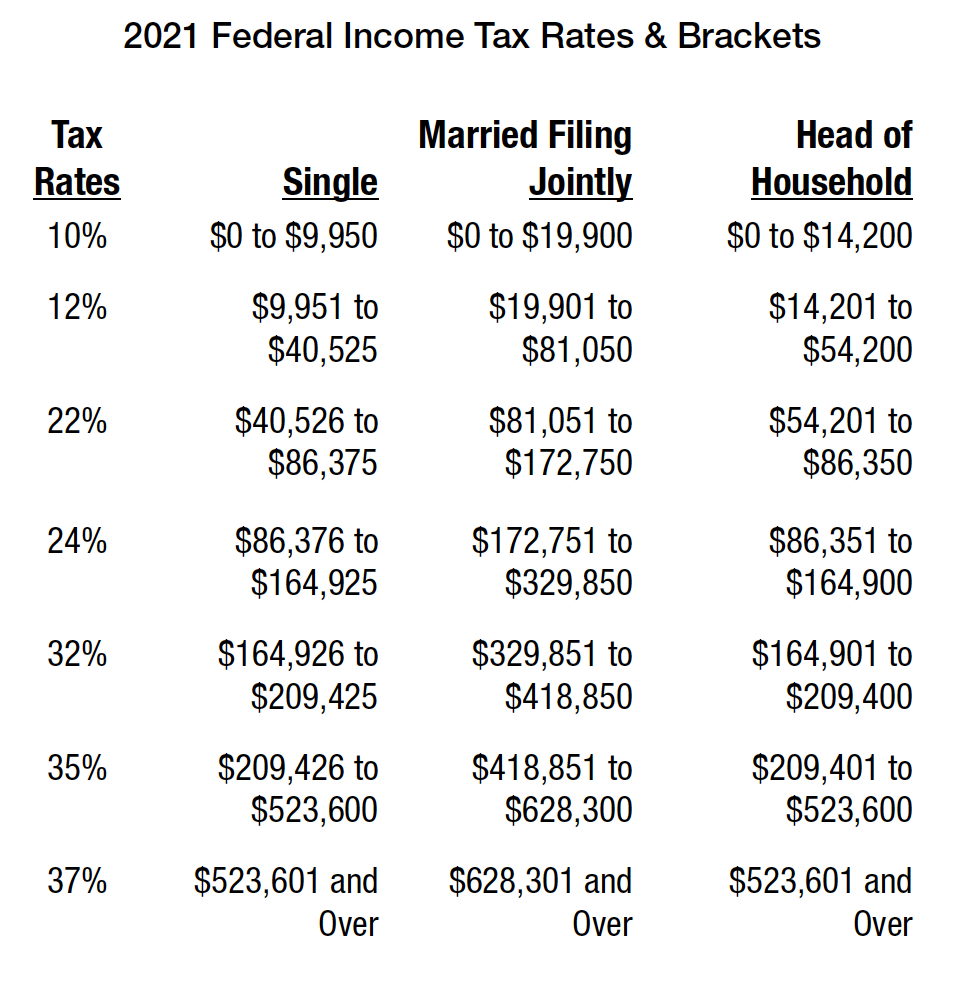

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

2021 Tax Thresholds Hkp Seattle

How To Handle Medical Expenses Including Marijuana On Your Tax Return Oregonlive Com

2021 2022 Tax Brackets And Federal Income Tax Rates Bankrate

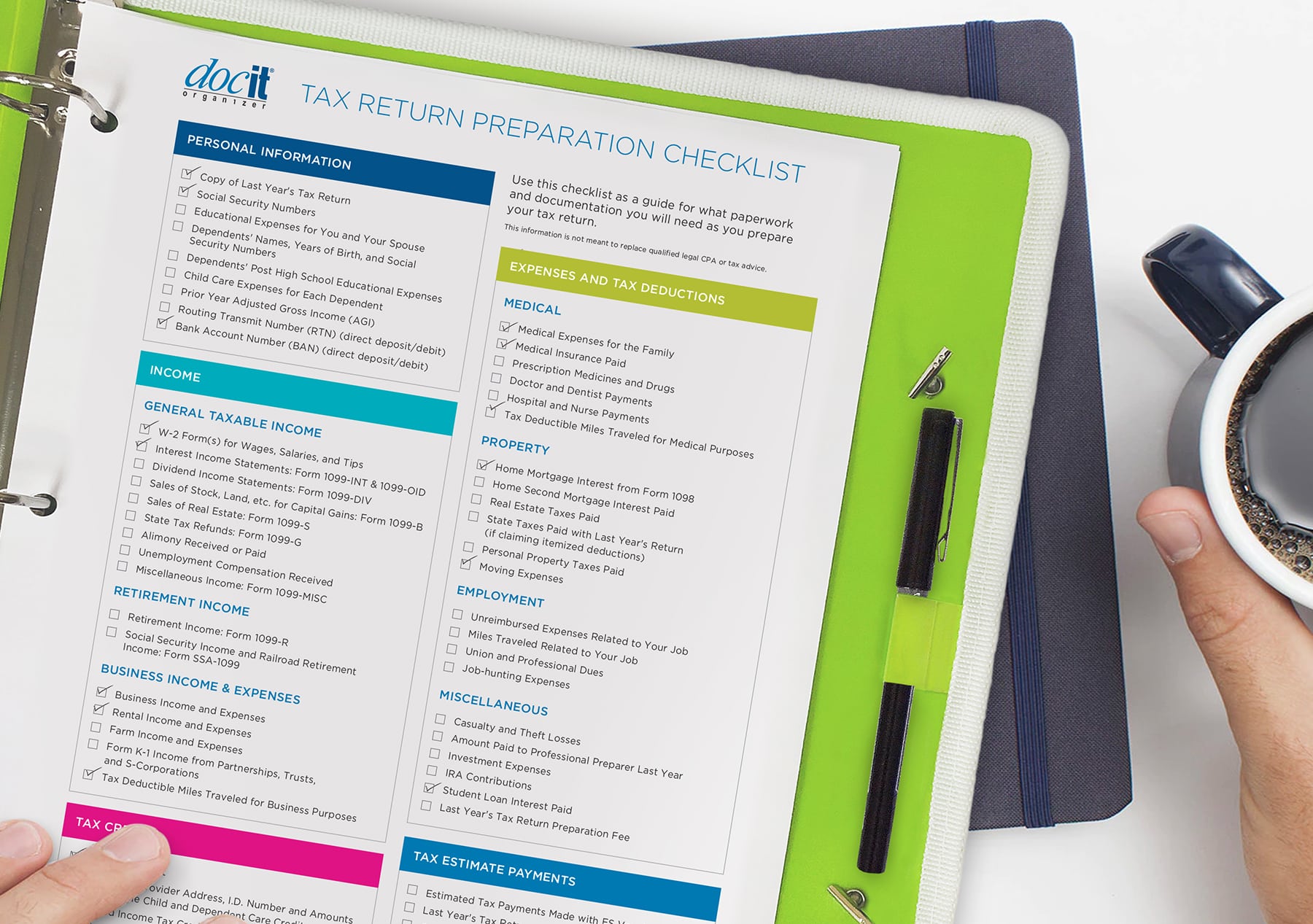

Docit Tax Return Prep Checklist Paris Corporation

2021 Tax Rates Quick Reference Guide Tax Brackets Tax Tables More Tax Pro Center Intuit

Tax Optimization Tax Planning Bogart Wealth

Deducting Your Home Office San Diego Tax Preparation

Normal Tax Return Preparation Fees Genesis Tax Consultants

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

10 Must Ask Tax Preparation Questions For Small Business Owners Bookkeeping Confidential

Publication 587 2021 Business Use Of Your Home Internal Revenue Service

How To Claim The Standard Mileage Deduction Get It Back

Unexpected Tax Bills For Simple Trusts After Tax Reform

Tax Strategies For Parents Of Kids With Special Needs The Autism Community In Action Taca